40+ Certified Letter From Irs Intent To Levy

You have a right to a hearing. This is called a CP504 letter.

However keep in mind that the law does not require the IRS to use any particular letter or notice number.

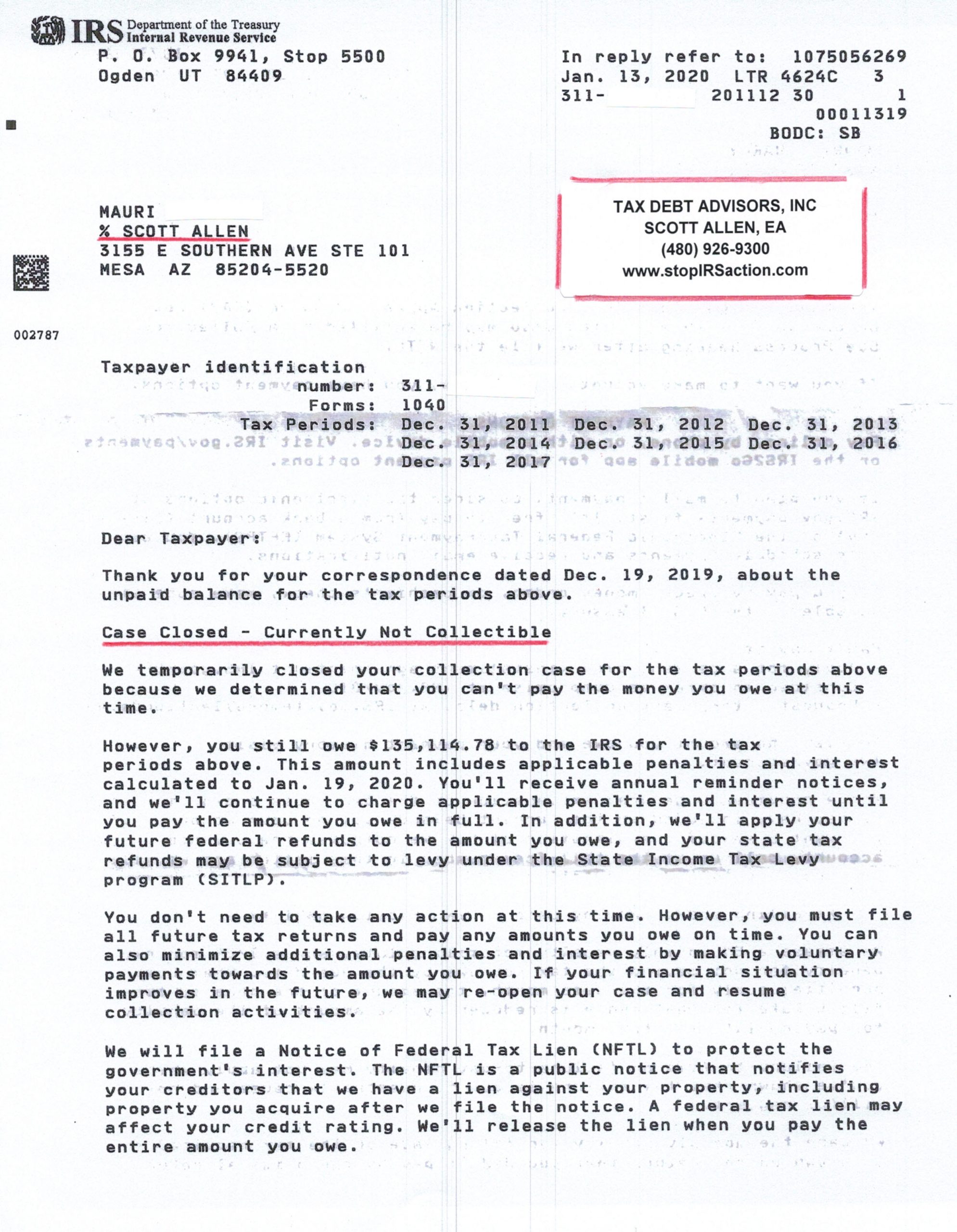

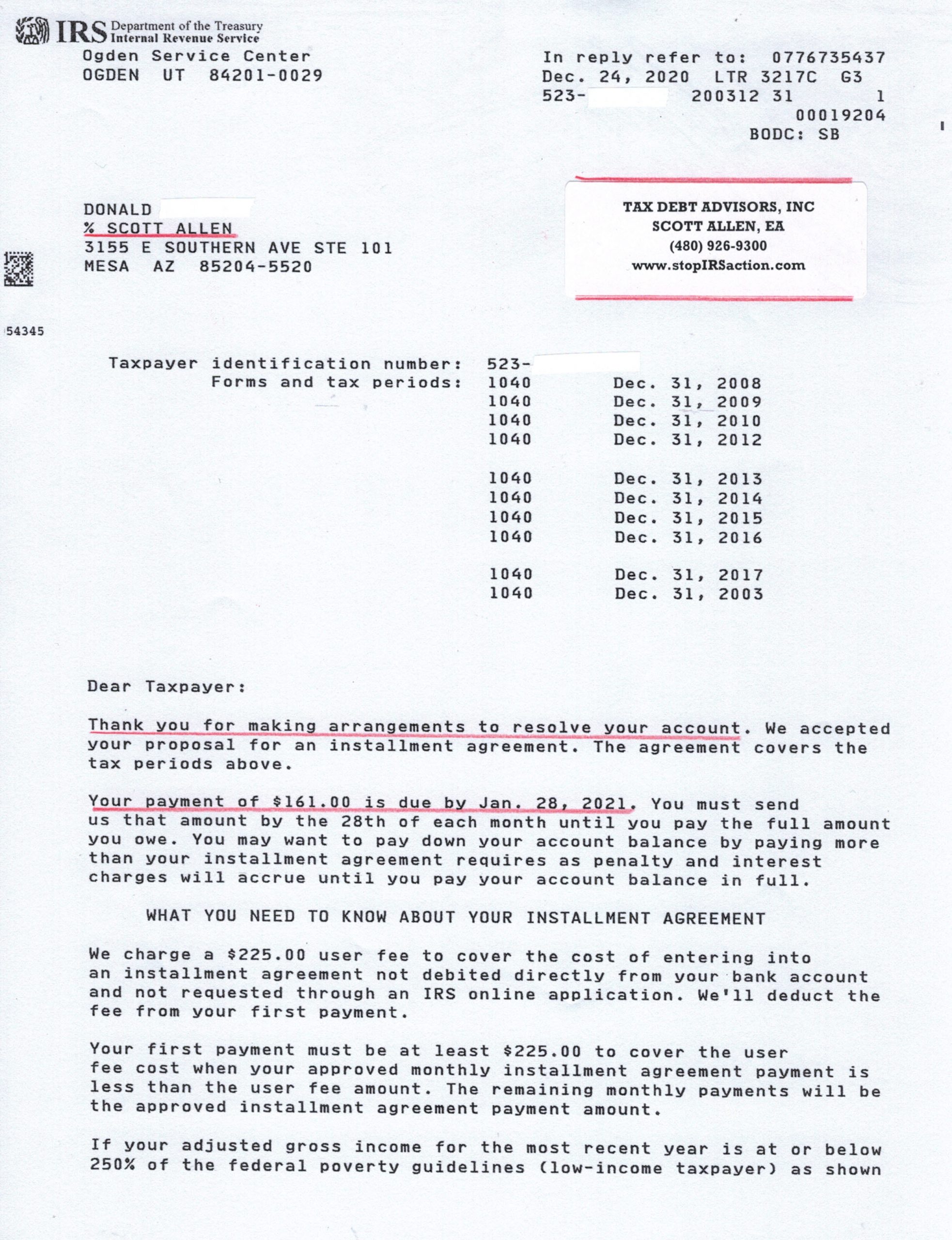

40+ certified letter from irs intent to levy. Rather the irs certified letter is the only legal action that needs to be taken in order to levy your bank account or levy your wages. Also known as a Notice of Intent to Levy and Notice of Your Rights to a Hearing Letter 1058 or LT11 is the final official document from the IRS before they begin garnishing your personal assets. To start the IRS will issue something called a Notice of Intent to Levy also known as Letter 1058 or LT-11.

This is a scare tactic. The IRS uses three letters for the Final Notice of Intent to Levy coded as either the LT11 LT1058 or CP90. What is a CP504 Letter.

The Internal Revenue Code stipulates that the Service must notify a taxpayer of intent to levy prior to a levy. An example of these is the IRS CP504 Letter or the Notice of Intent to Levy. At this hearing a taxpayer should present something called a proposed collection alternative or raise issues why they dont owe the tax that is claim innocent spouse relief or an audit reconsideration.

A Final Notice of Intent to Levy is the notice a taxpayer is given that they have 30 days to a right to claim something known as a Collection Due Process hearing. The CP297 notice is a formal notification that the IRS can levy your assets in 30 days. In this letter it states that failure to make a payment within 30 days from the date of the notice the IRS can put a levy to your property or rights to property.

The notices will typically have a notice or letter number in the upper right hand corner andor the lower right hand corner of the page. Before letting the panic get ahead of you use this guide to deconstruct IRS LT11 and understand the next steps toward dealing with your unpaid tax bill. The problem is the IRS may have sent you the Final Notice of Intent to Levy years ago.

This letter from the IRS serves as notification about the intent of the IRS to levy bank accounts and other financial assets resulting. However the CP297 is for businesses while the CP90 is for individuals. IRS Letter that states Final Notice Notice of Intent to Levy and Notice of Your Rights to a Hearing.

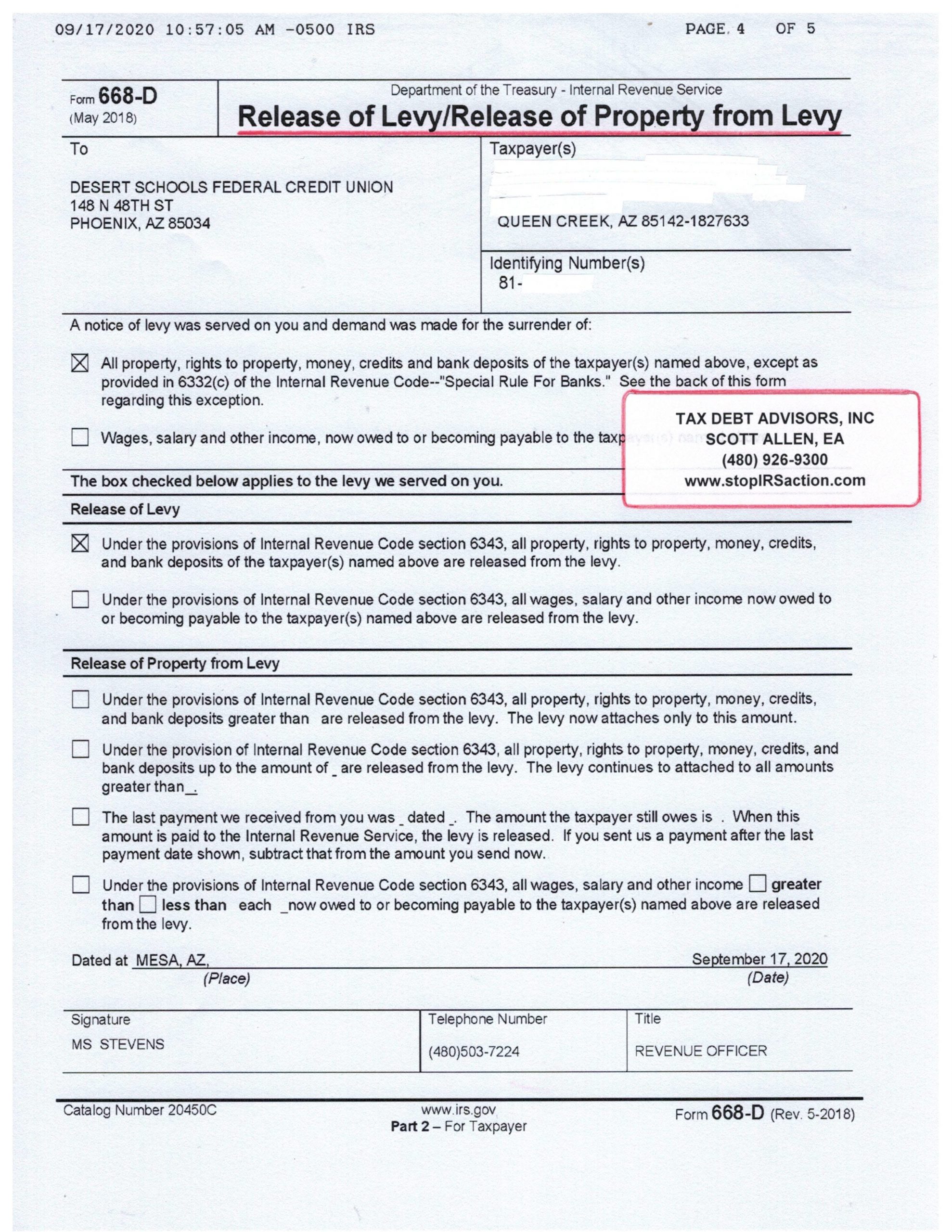

Anyone who receives this letter and reads this would typically be alarmed. After all without it the IRS cannot levy your wages bank accounts and property. Oftentimes the IRS will issue Notice of Intent to LevyIntent to seize your property or rights to property.

If it is a Letter 1058 a Notice LT 11 or a IRS Notice CP 90 it is the notice about which I am writing. Notice of intent to seize levy your property or rights to property. Letters 1058 and LT11 are sent as written notification required by law to inform you that the IRS intends to seize or levy your property or rights to property.

For instance the IRS sends through certified mail a letter called Final Notice Notice of Intent to Levy and Notice of Your Right to a Hearing the IRS usually calls this the CP90 or 1058 letter. A notice of intent to levy is the last letter the irs must send you before they can begin collection action assuming you dont dispute their tax assessment or pay up. This letter does not have teeth and the IRS cannot seize property unless a Final Notice has.

This Final Notice letter explains your rights and requests an immediate response. To the average inexperienced taxpayer the heading can be completely terrifying. You should not ignore this notice.

IRS Notice CP297 Intent to Levy. This notice is almost exactly the same as the CP90 Notice. W hatever letter or notice form of a Final Notice of Intent to Levy a Letter 1058 or a Letter 11 or a Notice CP90297 or a Notice CP92242 or an Alaska Notice 77 all are a Final Notice of Intent to Levy and provide you only 30 days to certified mail file for Collection Due Process rights which will stop IRS from further levy seizure.

The CP504 notice is one of the most misunderstood IRS notices. With the final notice you have rights to stop the levy before it happens and meet with an IRS settlement officer to negotiate a solution that is better than levy. Final Notice of Intent to Levy.

What this Means and What to Do. If youre ever unsure if what you received is actually a Notice of Intent to Levy a handy tip is to check the bottom right hand corner of the front page of the letter. The IRS Final Notice of Intent to Levy is probably the most important letter the IRS will send you.

IRS Letter 1058 or LT11 Final Notice of Intent to Levy. The Final Notice of Intent to Levy not the CP500s is required before a levy can be placed on your wages accounts or property. The next line appearing in a larger bold font states Amount due immediately.

What To Do If You Receive a CP297.

Https Www Capitol Hawaii Gov Session2019 Testimony Sb675 Testimony Wam 02 06 19 Pdf

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template 10 P Lettering Letter Templates Professional Templates

Https Www Calt Iastate Edu System Files Premium Video Files 2016 203 20preparing 20for 20an 20irs 20auditppnewpdf Pdf

Bahamas Financial Services Gateway Issue 4 By Ben Jamieson Issuu

Contoh Cash Collateral Sebagai Agunan Penerbitan Instrumen Perbankan Thriller Author Indonesia Perbankan Instrumen Tanda

The Irs Notice 1058 Is The Irs Telling You Their About To Levy Your Bank Account S If You Ve Gotten This Letter I Letter Templates Lettering How To Find Out

Consumers Responses To Cause Related Marketing Moderating Influence Of Cause Involvement And Skepticism On Attitude And Purchase Intention Request Pdf

City Council Meeting Minutes January 8 2009 City Of Xenia

Small Business Owners Did You Know Wave Small Business Software Bookkeeping Business Small Business Tax Small Business Finance

Mailing To Soverign States United States Postal Service Mail

Https Www Calt Iastate Edu System Files Premium Video Files 2016 203 20preparing 20for 20an 20irs 20auditppnewpdf Pdf

T24 290 Expanded Due Diligence Questions 30 Mar 2018 Ver 1 03 Databases Project Management

2020 Irs Wage Garnishment Laws How To Stop An Irs Garnishment Fsld